English follows Japanese,

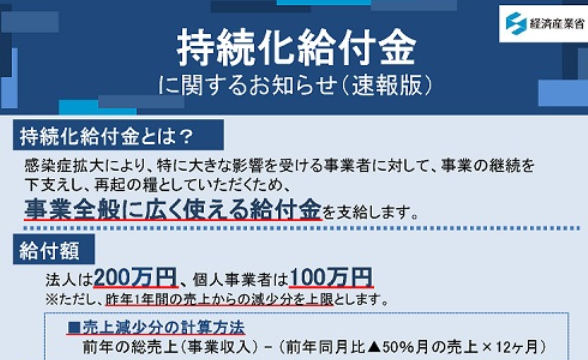

コロナ対策で様々な助成金等がありますが、

中小企業や個人事業のためにつくられた制度である

「持続化給付金」のご紹介をいたします。

すでにニュースでご存じの方も多いと思いますが、

法人は最大200万円、個人事業は最大100万円の

返済不要の給付です。

日本語版はこちらを見ていただくとわかりやすいと思います。

https://www.meti.go.jp/covid-19/pdf/kyufukin.pdf?fbclid=IwAR03LJx2giAUKhSSvZvjjcaY6sWIZruafR4GKFlNi0W4ga4HI9fYA_cYfxc

Japanese government has announced COVID-19 subsidy for the small business in Japan.

They have announced as follows, (Translation from the above link (METI))

————————————————————–

1, How much can we receive ?

Max two million yen for companies, one million yen for solo proprietor

-how to calculate-

(Gross Revenue of 2019) – ((any month revenue which is more than ▲50% of same month of 2019)× 12 months )

EX; Revenue in 2019 :30 mil yen

Every month revenue in 2019 : 2.5 mil yen

Revenue in March 2020 :1 mil yen (more than ▲50 % of March 2019 )

30 mil yen – (1 mil yen × 12 months ) = 18 mil yen → Max 2 mil yen subsidy.

2. When it will be started

They will announce the details at last week of April. Please wait for a while.

3. What information you need to apply

(1) Corporate number

(2) Tax returns in 2019

(3) Any proof to show reduced revenue ( Trial Balance should be good)

4. How to apply

on-line application

————————————————————–

We will announce when we receive the next information.

Our mission is support any business in Japan for non-Japanese/foreign companies!!