In our first newsletter we will cover the consumption tax that was raised in October this year.

1.How to calculate the consumption tax?

(Consumption tax received by customers) – (consumption tax paid by company) =consumption tax amount to be paid.

You need appropriate procedures to deduct consumption tax paid by company. What is it?

It is necessary to keep all invoices and record the accounts in your bookkeeping software or system in order to deduct the consumption tax.

Your company’s reputation would go up by having neat and organized books and paperwork if you are audited or there is a tax investigation. Speaking from experience, one of our clients had a tax investigation last month. In the end due, the tax department left with nothing, the client won the case with the statement of ”Approval of all declaration”, which is recognized as perfect taxation process by Japanese tax authority. One of the major contributing factors was because the client kept the necessary documents correctly, the tax investigation was completed very quickly and reduced costs and stress for the client.

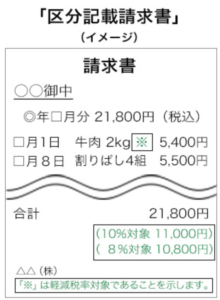

2.What is “Classification invoice” (Kubunkisai Seikyusho) ?

The introduction of classification invoices has started from October 2019 along with the reduced tax rate introduced from October 2019.

The invoice added the following 2 items is called “classification invoice.

* A notice of the reduced tax rate

* Total amount for each tax rate

If this is news to you don’t worry. The classification invoices are issued by any business who sell food, beverages, and newspapers with the reduced tax rate. Others can issue the same invoice as before.

With that said, if your company receives a classification invoice, they need to keep it as proof in case of an investigation.

3.How should I do if I receive the wrong invoice?

If you receive a standard invoice even if you purchased goods mixed with the different tax rates of 8% and 10%,

You can add the above point *on the invoice by yourself, There is no need to ask the company to revise the invoice.

Of course, please don’t revise date or the amount of the received invoice yourself, just in case!

Thank you very much for reading our first newsletter!

What did you think? We value your opinion and hope for any feedback you might have to improve the newsletter.